Articles

2 min read

The Future of Private Markets

Tim Mckenzie

/Global private capital markets are entering a new phase of sustained growth, with industry forecasts consistently pointing to a significant expansion in assets under management over the coming decade.

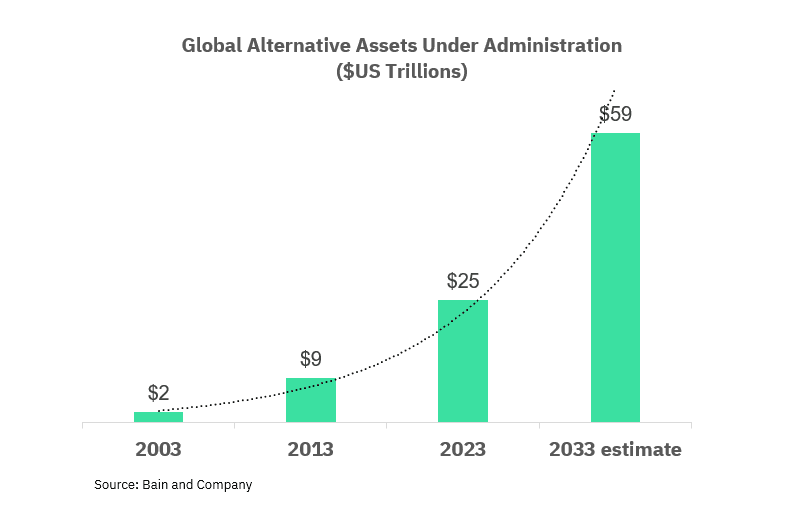

PitchBook projects global private markets AUM to grow by approximately 28% over the next five years, while BlackRock anticipates even stronger growth over a similar period. Longer-term projections reinforce this outlook, with Bain & Company forecasting global private markets AUM to reach approximately $59 trillion by 2033.

Driving Forces of Private Market Growth

While private capital markets have experienced steady growth for many years, there are several structural and cyclical factors that are underpinning the next era of expansion.

Institutional and Retail Investors Increasing Allocations to Alternative Investments Institutional Investors - The public markets’ IPO pipeline has contracted in recent years, constraining liquidity pathways and limiting opportunities for new public listings.

As a result, institutional investors, sovereign wealth funds, pension plans, and insurance companies are increasing allocations to alternatives in search of higher and more stable risk-adjusted returns amid ongoing public market volatility and return compression.

This sustained institutional demand is a major driver of growth in demand for private market assets.

Retail Investors - Retail participation in broader markets has grown sharply, with retail investors now accounting for approximately 20.5% of daily trading volume in U.S. equity markets.

Although retail allocations to private assets have historically been limited, this is rapidly changing.

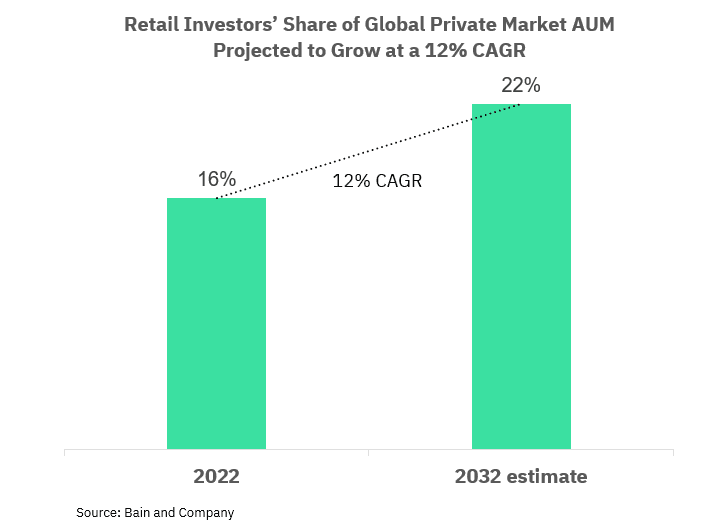

As platforms, product structures, and regulations evolve, retail investor participation in private markets is expected to rise meaningfully. Bain’s projections suggest that retail investors’ share of total private market AUM could increase from around 16% in 2022 to roughly 22% by 2032, as individuals seek diversification and stronger yield potential and are more willing to accept lower liquidity profiles.

Generational shifts in investor attitudes also support this trend.

A 2025 survey of 1,000 high-net-worth investors conducted by Goldman Sachs Asset Management shows that familiarity with, and allocations to, private markets are higher among younger generations.

Evolving Market Structure

Private markets are becoming more accessible to a broader range of investors, and evolution in investment products and regulation is paving the way.

In the wealth management space, asset managers and private banks are rolling out innovative structures that offer periodic liquidity in traditionally illiquid private market vehicles.

To support increased demand, regulatory frameworks are also evolving to support capital formation. In Canada, the Listed Issuer Financing Exemption has been expanded to allow listed companies to raise higher capital amounts more efficiently, reflecting a broader effort to enhance private capital access. At the same time, the Self-Certified Investor Prospectus Exemption is being harmonized and expanded to facilitate greater participation by certified individual investors in private offerings.

Globally, new market entrants focused exclusively on private market financings are emerging. For example, the UK is advancing PISCES, a framework for trading private company shares, with the London Stock Exchange slated to operate a dedicated Private Securities Market under this regime, a significant development for private share liquidity.

Markette Ventures and the Canadian Evolution

We founded Markette Ventures to help bridge the gap between companies seeking efficient access to private capital and investors looking for differentiated opportunities. Our end-to-end digital platform is designed specifically to support private placements, a key evolution in the Canadian private capital landscape that enhances efficiency, transparency, and investor access.

Disclaimers

This content is intended for general information purposes only. It is not, and should not be construed as, investment advice or a solicitation to buy or sell a particular security or to pursue a particular investment strategy. This article is not tailored for and does not have regard to the particular circumstances or needs of any specific person who may read or receive this information. Markette Ventures makes no representation or warranty, express or implied, that the information contained in this article is accurate or complete.

This article may contain forward-looking statements. There are inherent risks, assumptions and uncertainties regarding forward-looking statements which could lead to results that vary from expectations expressed in such forward-looking statements.

The information in this article has not been independently verified by Markette Ventures. Markette Ventures does not endorse any third parties or their advice, opinions, information, products or services that may be referenced in this article. Markette Ventures disclaims any and all liability relating to the information in this article and is not liable for any errors or omissions in such information or for any loss or damage suffered, directly or indirectly, from the use of this information.

Private capital markets investing involves risk. Investors should seek their own legal, financial and tax advice to assess the risks and the suitability of investing in any securities or pursuing any investment strategy.

For more information, please refer to our Terms of Use.

Insights